Does Homeowners Insurance Cover Water Damage?

“Does homeowners insurance cover water damage?” is a question that people ask thousands of times each year. It’s not one you want to ask after a plumbing emergency.

In short, unfortunately for those facing a ruined floor or ceiling, insurance coverage is complex and the answer isn’t as easy as it should be; a lot depends on the plan that you purchased. Is it generic coverage or did you plan ahead and purchase a water damage insurance addendum (an add-on)?

Water damage is coverable by insurance in some cases. There are limitations in what and how much is coverable unless unless you purchased specific water damage coverage. More so, let’s review what is and is not coverable under most general homeowners insurance plans.

When Is Water Damage Covered?

Above all, believe it or not, your insurance does usually provide coverage for these incidents:

- If a sudden event causes water damage, it is usually coverable. This does not apply to flooding from rain or a rising body of water nearby.

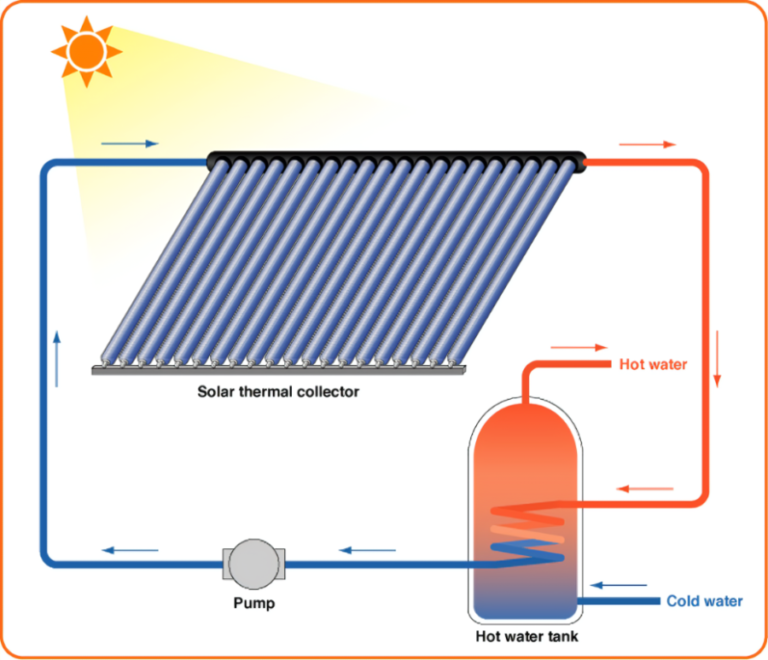

- Sudden flooding from a burst pipe, a broken hot water heater or a broken washing machine hose may lead to some damages, and insurance will cover these.

- The same applies if a dishwasher breaks or a toilet overflows. If there are other damages that occurred over the span of several months because the toilet was leaking and was not repairable, those damages are not eligible for coverage.

PRO TIP: The cost of replacing a water damaged floor after a dishwasher breaks should be coverable. However, the cost of replacing the dishwasher is not because it was the source of the damage.

When Is Water Damage Not Covered?

Likewise, as a rule, any water damage that results from neglected plumbing issues is not coverable. People often underestimate the seriousness of a leaky faucet, shower head or toilet. Here are several items that are not generally coverable:

- Pipes in basements that leak often lead to mold or mildew collecting. If mold is collecting, it is usually a sign of slow-developing water damage. Ruined floor boards, sink cabinets, walls, beams and carpeting are not coverable if the damage has been building. This is why every homeowner must inspect the home regularly for any signs of moisture.

- Prompt reporting is the key to compensation. If a hot water heater breaks and floods a room, They will not cover it if you did not report the damage immediately.

- They will not cover flooding from an outside sewer drain backup. So keep those sewer drains clean on a regular basis, perhaps once every one to two years.

PRO TIP: You can cover flood damage is only by a separate policy. You can typically purchase flood insurance from the government’s National Flood Insurance Program.

How To Prevent Water Damage

Subsequently, the best way to ensure that insurance will cover certain damages is to frequently inspect your home for any problems that have the potential to cause water damage. In addition, the more you do in advance to mitigate a problem area — and the more you can document — the better chance you’ll have of getting the damage paid for by your insurance provider.

- Fix leaky faucets and toilets immediately.

- Toilets that flush twice, run too long, or have other issues you should repair promptly. Toilet failure is the leading cause of water damage in the United States.

- Water damage from water that seeps behind the walls of a home. This often results from a crack in the structure or a hole in the roof. Keeping the roof in good repair is a must, and be sure to clean the gutters frequently to avoid destructive clogs.

- Down spouts should be in good repair and should route away from homes or garages.

- Inspection of dishwasher and washing machine hoses should happen frequently and replaced or tightened as needed.

- Check visible pipes frequently to look for signs of leaks, and look under bathroom and kitchen sinks weekly to see if any pipes are dripping.

PRO TIP: Most importantly, if a plumbing emergency arises, then turn off your water source immediately. This is especially true if the emergency involves gushing or leaking water. Try to clean up as much water as possible, and call your plumber promptly. Document everything with photos or videos (or both).

Conclusion

So, “does homeowners insurance cover water damage?” In conclusion, the message here is simple. If you want to increase the odds that any water damage you suffer your insurance will cover, do these three things:

- Address problem issues around your home before any water damage occurs, and document everything you’ve done.

- Contact your insurance provider and have them explain what is and isn’t covered by water damage.

- Contact your plumber to learn more about preparedness and preventing water damage — your plumber should be able to perform an audit of your home’s potential problem areas.

Call 1-Tom-Plumber if You Need More Help

Moreover, don’t hesitate to contact us here or call us at 1-Tom-Plumber (1-866-758-6237). We will immediately handle any emergency plumbing, drain cleaning and drain clearing, and water damage problem, including excavation of underground water lines and sewer main lines.